GET INSURANCE

GET INSURANCE

GET INSURANCE

Your protection is our priority – let us guide you

Your protection is our priority – let us guide you

Your protection is our priority – let us guide you

Let us guide you through the world of protection. Whether you’re looking for life insurance, critical illness cover, or income protection, we’ve helped clients safeguard everything from their family’s future to their financial security in times of uncertainty. With our expertise, we’re confident we can save you money, time, and unnecessary worry

Let us guide you through the world of protection. Whether you’re looking for life insurance, critical illness cover, or income protection, we’ve helped clients safeguard everything from their family’s future to their financial security in times of uncertainty. With our expertise, we’re confident we can save you money, time, and unnecessary worry

Let us guide you through the world of protection. Whether you’re looking for life insurance, critical illness cover, or income protection, we’ve helped clients safeguard everything from their family’s future to their financial security in times of uncertainty. With our expertise, we’re confident we can save you money, time, and unnecessary worry

OUR SERVICES: EXPERT GUIDANCE FOR YOUR PROTECTION NEEDS

OUR SERVICES: EXPERT GUIDANCE FOR YOUR PROTECTION NEEDS

OUR SERVICES: EXPERT GUIDANCE FOR YOUR PROTECTION NEEDS

Many people aren’t aware of the range of options available to protect themselves and their loved ones financially. With the right protection, you can ensure peace of mind and security for the future. Let our expert advisors guide you through the process, helping you find the ideal life insurance, critical illness cover, or income protection policy to suit your needs, all while giving you the confidence that you’re fully covered

See what I'm eligible for

YOU SHOULD CONSIDER INCOME PROTECTION IF

You rely on your income for living costs, a mortgage, or supporting your family. Income protection provides a safety net, covering a portion of your earnings if illness or injury prevents you from working.

YOU SHOULD CONSIDER CRITICAL ILLNESS IF:

Protect your finances with critical illness cover. If diagnosed with a serious condition, you’ll receive a lump sum payout to help cover medical costs, mortgage payments, or daily expenses, ensuring peace of mind during recovery

WHAT TYPE OF COVER ARE YOU LOOKING FOR?

WHAT TYPE OF COVER ARE YOU LOOKING FOR?

WHAT TYPE OF COVER ARE YOU LOOKING FOR?

There are many types of protection products available, and we’ve outlined some key options below. However, everyone’s needs are unique, so get in touch today to find the best solution tailored to you.

EXPLORE YOUR OPTIONS

RELEVANT LIFE INSURANCE

A tax-efficient life cover policy for employees or directors, paid by their employer. It provides a lump sum to their family if the insured passes away during their employment

DECREASING TERM ASSURANCE

A policy where the payout decreases over time, often matching a repayment mortgage. It ensures outstanding debts are covered, providing affordable protection for financial commitments that reduce over time.

LEVEL TERM LIFE ASSURANCE

A policy that provides a fixed lump sum payout if the policyholder passes away during the term. The payout amount remains the same throughout, offering consistent financial protection.

SELF-EMPLOYED PROTECTION POLICIES

Designed for self-employed individuals, these policies provide financial security by covering lost income due to illness or injury. Options include income protection, critical illness cover, and life insurance.

LIFE INSURANCE FOR SMOKERS

Life insurance for smokers typically comes with higher premiums due to increased health risks. However, tailored policies ensure financial protection for your loved ones despite these higher costs.

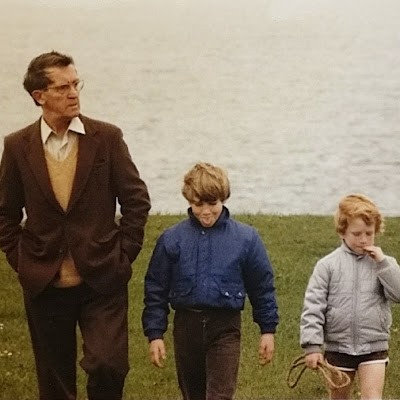

As a freelance musician with complex employment contracts, securing a competitive remortgage was tougher than I expected. Barrett Mortgages made it seamless and got me a better rate than I’d hoped for. I highly recommend them!

"I recently had the pleasure of working with Barrett Mortgage Brokers while securing a mortgage for my new home, and I couldn't be more satisfied”

J Burke - London - Freelance Musician

Why choose Barrett Mortgages?

Why choose Barrett Mortgages?

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

5* Reviews

5* Reviews

Successful Mortgage Completions

Successful Mortgage Completions

Average response time

Average response time

Chat with a Specialist

Chat with a Specialist

Chat with a Specialist

Chat with a Specialist

Who will guide you through the qualification process. During our initial consultation, we aim to provide an idea of your maximum loan amount, monthly payments, and associated costs where possible, while answering any questions you may have.

Who will guide you through the qualification process. During our initial consultation, we aim to provide an idea of your maximum loan amount, monthly payments, and associated costs where possible, while answering any questions you may have.

Who will guide you through the qualification process. During our initial consultation, we aim to provide an idea of your maximum loan amount, monthly payments, and associated costs where possible, while answering any questions you may have.

Find your solution

Find your solution

Find your solution

Find your solution

Once we have found your solution one of our dedicated advisor's will compare all suitable products and prepare your mortgage application. We’ll then handle the submission and work towards securing your formal mortgage offer.

Once we have found your solution one of our dedicated advisor'will compare all suitable products and prepare your mortgage application. We’ll then handle the submission and work towards securing your formal mortgage offer.

Once we have found your solution one of our dedicated advisor'will compare all suitable products and prepare your mortgage application. We’ll then handle the submission and work towards securing your formal mortgage offer.

Turn Your Dream into Reality

Turn Your Dream into Reality

Turn Your Dream into Reality

Turn Your Dream into Reality

We’ll make the final steps as smooth as possible, coordinating with lenders to ensure a seamless process! —ready for you to get the confirmation to your new venture!

We’ll make the final steps as smooth as possible, coordinating with lenders to ensure a seamless process! —ready for you to get the confirmation to your new venture!

We’ll make the final steps as smooth as possible, coordinating with lenders to ensure a seamless process! —ready for you to get the confirmation to your new venture!

Blogs relevant to this topic

Blogs relevant to this topic

Blogs relevant to this topic

Blog

Let Barrett Mortgages do the searching – and we’ll find the right solution for you.

Let Barrett Mortgages do the searching – and we’ll find the right solution for you.

Click. Chat. Complete!

Click now to connect with our team. After discussing your circumstances, we’ll recommend the best path to completion.

Click now to connect with our team. After discussing your circumstances, we’ll recommend the best path to completion.

Click now to connect with our team. After discussing your circumstances, we’ll recommend the best path to completion.