FIRST TIME BUYER

FIRST TIME BUYER

FIRST TIME BUYER

Making Home Ownership a Reality: A Guide for First-Time Buyers

Making Home Ownership a Reality: A Guide for First-Time Buyers

Making Home Ownership a Reality: A Guide for First-Time Buyers

We understand that the home buying process can be overwhelming, particularly for first-time buyers who may be unfamiliar with the market and the range of financing options available. That’s why we provide a tailored roadmap, designed specifically for you, to guide you through the journey of homeownership.

We understand that the home buying process can be overwhelming, particularly for first-time buyers who may be unfamiliar with the market and the range of financing options available. That’s why we provide a tailored roadmap, designed specifically for you, to guide you through the journey of homeownership.

We understand that the home buying process can be overwhelming, particularly for first-time buyers who may be unfamiliar with the market and the range of financing options available. That’s why we provide a tailored roadmap, designed specifically for you, to guide you through the journey of homeownership.

OUR SERVICES: SIMPLIFYING YOUR MORTGAGE JOURNEY

OUR SERVICES: SIMPLIFYING YOUR MORTGAGE JOURNEY

OUR SERVICES: SIMPLIFYING YOUR MORTGAGE JOURNEY

Achieving homeownership, a significant milestone for many, can also feel overwhelming due to the abundance of conflicting advice. Allow our expert advisors to guide you through the entire process. From the first point of contact, we’ll help you determine your borrowing capacity, provide a comprehensive breakdown of costs, and secure an agreement in principle. Becoming a qualified purchaser, you’ll gain an advantageous position with estate agents and sellers, making your dream home more attainable.

See what I'm eligible for

YOU ARE A FIRST-TIME BUYER IF:

you have never owned a residential property either in the UK or abroad If you have only owned a commercial property without any living space attached to it, such as a pub with upstairs accommodation

YOU’RE NOT A FIRST-TIME BUYER IF:

you are purchasing a property with someone who currently owns or has previously owned a home, you may not be eligible as a first-time buyer. If you have inherited a home, even if they never lived in it and it has since been sold.

MORTGAGE SOLUTIONS TAILORED TO EVERY CIRCUMSTANCE

MORTGAGE SOLUTIONS TAILORED TO EVERY CIRCUMSTANCE

MORTGAGE SOLUTIONS TAILORED TO EVERY CIRCUMSTANCE

At Barrett Mortgages, we understand that everyone’s financial situation and goals are unique. That’s why we offer bespoke mortgage solutions designed to suit your individual needs.

EXPLORE YOUR OPTIONS

EXPERT MORTGAGE SOLUTIONS TO HELP YOU BUY YOUR FIRST HOME

Receive tailored mortgage solutions designed to guide you through every step of the process, helping you confidently take your first step onto the property ladder.

EXCLUSIVE PRODUCTS AND BENEFITS FOR FIRST-TIME BUYERS

Unlock a range of exclusive mortgage products and benefits designed to make buying your first home easier, more affordable, and stress-free.

NEW BUILD AND SHARED OWNERSHIP GOVERNMENT SCHEMES

Take advantage of government-backed initiatives designed to make owning a home more achievable, including tailored options for new build properties, shared ownership arrangements, and the Forces Help to Buy scheme.

SOLUTIONS FOR SELF-EMPLOYED FIRST-TIME BUYERS

Including solutions for self-employed first-time buyers with only one year’s income, our tailored options make it easier to navigate the process, even with non-traditional earnings.

6X INCOME MORTGAGE

Boost your mortgage borrowing capacity with a 6x Income Mortgage. If you meet the specific eligibility criteria, you could qualify for a mortgage 6 times your earnings. So you could increase your budget by up to 20%.

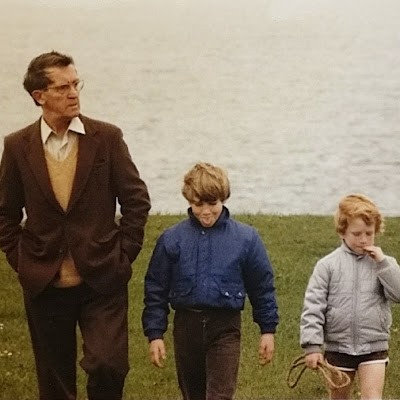

As a freelance musician with complex employment contracts, securing a competitive remortgage was tougher than I expected. Barrett Mortgages made it seamless and got me a better rate than I’d hoped for. I highly recommend them!

"I recently had the pleasure of working with Barrett Mortgage Brokers while securing a mortgage for my new home, and I couldn't be more satisfied”

J Burke - London - Freelance Musician

Why choose Barrett Mortgages?

Why choose Barrett Mortgages?

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

5* Reviews

5* Reviews

Successful Mortgage Completions

Successful Mortgage Completions

Average response time

Average response time

Chat with a Specialist

Chat with a Specialist

Chat with a Specialist

Chat with a Specialist

Who will guide you through the qualification process. During our initial consultation, we aim to provide an idea of your maximum loan amount, monthly payments, and associated costs where possible, while answering any questions you may have.

Who will guide you through the qualification process. During our initial consultation, we aim to provide an idea of your maximum loan amount, monthly payments, and associated costs where possible, while answering any questions you may have.

Who will guide you through the qualification process. During our initial consultation, we aim to provide an idea of your maximum loan amount, monthly payments, and associated costs where possible, while answering any questions you may have.

Find your solution

Find your solution

Find your solution

Find your solution

Once we have found your solution one of our dedicated advisor's will compare all suitable products and prepare your mortgage application. We’ll then handle the submission and work towards securing your formal mortgage offer.

Once we have found your solution one of our dedicated advisor'will compare all suitable products and prepare your mortgage application. We’ll then handle the submission and work towards securing your formal mortgage offer.

Once we have found your solution one of our dedicated advisor'will compare all suitable products and prepare your mortgage application. We’ll then handle the submission and work towards securing your formal mortgage offer.

Turn Your Dream into Reality

Turn Your Dream into Reality

Turn Your Dream into Reality

Turn Your Dream into Reality

We’ll make the final steps as smooth as possible, coordinating with lenders to ensure a seamless process! —ready for you to get the confirmation to your new venture!

We’ll make the final steps as smooth as possible, coordinating with lenders to ensure a seamless process! —ready for you to get the confirmation to your new venture!

We’ll make the final steps as smooth as possible, coordinating with lenders to ensure a seamless process! —ready for you to get the confirmation to your new venture!

Blogs relevant to this topic

Blogs relevant to this topic

Blogs relevant to this topic

Blog

Let Barrett Mortgages do the searching – and we’ll find the right solution for you.

Let Barrett Mortgages do the searching – and we’ll find the right solution for you.

Click. Chat. Complete!

Click now to connect with our team. After discussing your circumstances, we’ll recommend the best path to completion.

Click now to connect with our team. After discussing your circumstances, we’ll recommend the best path to completion.

Click now to connect with our team. After discussing your circumstances, we’ll recommend the best path to completion.