LATER LIFE & LIFETIME MORTGAGES

LATER LIFE & LIFETIME MORTGAGES

LATER LIFE & LIFETIME MORTGAGES

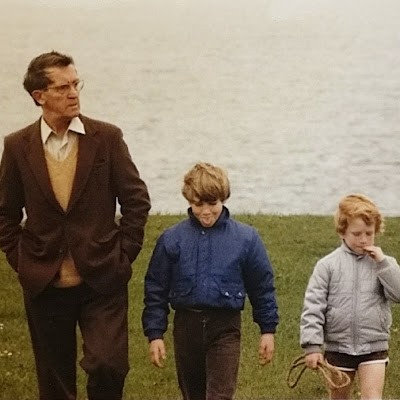

How Equity Release Can Provide Financial Freedom in Later Life

How Equity Release Can Provide Financial Freedom in Later Life

How Equity Release Can Provide Financial Freedom in Later Life

Your home is likely your biggest asset, and unlocking its value could provide financial freedom in later life. Whether you’re looking to release equity for home improvements, clear existing debts, or boost your retirement income, we’ll guide you through the best options available—helping you make the most of your property wealth every step of the way.

Your home is likely your biggest asset, and unlocking its value could provide financial freedom in later life. Whether you’re looking to release equity for home improvements, clear existing debts, or boost your retirement income, we’ll guide you through the best options available—helping you make the most of your property wealth every step of the way.

Your home is likely your biggest asset, and unlocking its value could provide financial freedom in later life. Whether you’re looking to release equity for home improvements, clear existing debts, or boost your retirement income, we’ll guide you through the best options available—helping you make the most of your property wealth every step of the way.

EXPERT SUPPORT FOR EQUITY RELEASE AND LIFETIME MORTGAGES

EXPERT SUPPORT FOR EQUITY RELEASE AND LIFETIME MORTGAGES

EXPERT SUPPORT FOR EQUITY RELEASE AND LIFETIME MORTGAGES

Equity release and lifetime mortgages can be valuable financial tools, but they’re not the right choice for everyone. That’s why our expert advisors are here to provide clear, honest guidance—helping you explore all the options, understand the benefits and potential drawbacks, and ensure you make the best decision for your circumstances. Whether you’re looking to supplement your retirement income, fund home improvements, or explore tax planning opportunities, we’ll support you every step of the way, ensuring you have all the information you need to move forward with confidence.

See what I'm eligible for

YOU MAY NOT NEED A LIFETIME MORTGAGE IF:

You are under the age of 55, are not nearing retirement, have a stable income, and qualify for a conventional mortgage or another financial mortgage product. You may also have savings, investments, or other assets that better suit your financial needs.

WHAT TYPE OF LIFETIME MORTGAGE ARE YOU LOOKING FOR?

WHAT TYPE OF LIFETIME MORTGAGE ARE YOU LOOKING FOR?

WHAT TYPE OF LIFETIME MORTGAGE ARE YOU LOOKING FOR?

There are several types of lifetime mortgages, each designed to suit different needs. We’ve highlighted some of the most common options below, but everyone’s circumstances are unique. Contact us today to find the right solution for you.

EXPLORE YOUR OPTIONS

EQUITY RELEASE

Explore our tips below on how to maximise the benefits of equity release by planning ahead. Our team will manage the entire process and provide expert guidance to help you find the right solution for your needs.

RETIREMENT INTEREST ONLY

A Retirement Interest-Only (RIO) mortgage can be a straightforward way to manage your finances in later life, but is it the best option for you? Barrett Mortgages advisors will help you weigh the pros and cons to ensure it suits your needs and long-term plans.

As a freelance musician with complex employment contracts, securing a competitive remortgage was tougher than I expected. Barrett Mortgages made it seamless and got me a better rate than I’d hoped for. I highly recommend them!

"I recently had the pleasure of working with Barrett Mortgage Brokers while securing a mortgage for my new home, and I couldn't be more satisfied”

J Burke - London - Freelance Musician

Why choose Barrett Mortgages?

Why choose Barrett Mortgages?

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

5* Reviews

5* Reviews

Successful Mortgage Completions

Successful Mortgage Completions

Average response time

Average response time

Chat with a Specialist

Chat with a Specialist

Chat with a Specialist

Chat with a Specialist

Who will guide you through the qualification process. During our initial consultation, we aim to provide an idea of your maximum loan amount, monthly payments, and associated costs where possible, while answering any questions you may have.

Who will guide you through the qualification process. During our initial consultation, we aim to provide an idea of your maximum loan amount, monthly payments, and associated costs where possible, while answering any questions you may have.

Who will guide you through the qualification process. During our initial consultation, we aim to provide an idea of your maximum loan amount, monthly payments, and associated costs where possible, while answering any questions you may have.

Find your solution

Find your solution

Find your solution

Find your solution

Once we have found your solution one of our dedicated advisor's will compare all suitable products and prepare your mortgage application. We’ll then handle the submission and work towards securing your formal mortgage offer.

Once we have found your solution one of our dedicated advisor'will compare all suitable products and prepare your mortgage application. We’ll then handle the submission and work towards securing your formal mortgage offer.

Once we have found your solution one of our dedicated advisor'will compare all suitable products and prepare your mortgage application. We’ll then handle the submission and work towards securing your formal mortgage offer.

Turn Your Dream into Reality

Turn Your Dream into Reality

Turn Your Dream into Reality

Turn Your Dream into Reality

We’ll make the final steps as smooth as possible, coordinating with lenders to ensure a seamless process! —ready for you to get the confirmation to your new venture!

We’ll make the final steps as smooth as possible, coordinating with lenders to ensure a seamless process! —ready for you to get the confirmation to your new venture!

We’ll make the final steps as smooth as possible, coordinating with lenders to ensure a seamless process! —ready for you to get the confirmation to your new venture!

Blogs relevant to this topic

Blogs relevant to this topic

Blogs relevant to this topic

Blog

Let Barrett Mortgages do the searching – and we’ll find the right solution for you.

Let Barrett Mortgages do the searching – and we’ll find the right solution for you.

Click. Chat. Complete!

Click now to connect with our team. After discussing your circumstances, we’ll recommend the best path to completion.

Click now to connect with our team. After discussing your circumstances, we’ll recommend the best path to completion.

Click now to connect with our team. After discussing your circumstances, we’ll recommend the best path to completion.