MOVING HOME

MOVING HOME

MOVING HOME

Moving Home Made Simple: Your Next Chapter Begins Here

Moving Home Made Simple: Your Next Chapter Begins Here

Moving Home Made Simple: Your Next Chapter Begins Here

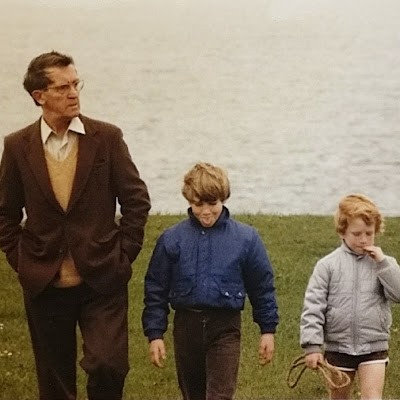

Relocating to a new home is an exciting journey but can also feel overwhelming, especially if you haven’t navigated the property market recently. At Barrett Mortgages, we’re committed to understanding your unique needs. Our personalised roadmap will support you every step of the way—whether you’re upsizing, downsizing, or relocating—ensuring your move is seamless and stress-free.

Relocating to a new home is an exciting journey but can also feel overwhelming, especially if you haven’t navigated the property market recently. At Barrett Mortgages, we’re committed to understanding your unique needs. Our personalised roadmap will support you every step of the way—whether you’re upsizing, downsizing, or relocating—ensuring your move is seamless and stress-free.

Relocating to a new home is an exciting journey but can also feel overwhelming, especially if you haven’t navigated the property market recently. At Barrett Mortgages, we’re committed to understanding your unique needs. Our personalised roadmap will support you every step of the way—whether you’re upsizing, downsizing, or relocating—ensuring your move is seamless and stress-free.

OUR SERVICES: SIMPLIFYING YOUR MORTGAGE JOURNEY

OUR SERVICES: SIMPLIFYING YOUR MORTGAGE JOURNEY

OUR SERVICES: SIMPLIFYING YOUR MORTGAGE JOURNEY

Moving home, a significant step in life, can feel daunting due to added complexities. Unlike first-time buyers, you may need to decide whether to keep or change your current property or mortgage. Let our expert advisors guide you, helping you assess affordability, break down costs, and secure a mortgage agreement in principle. As an experienced buyer, you’ll gain a stronger position with estate agents and sellers, ensuring your next dream home is within reach.

LET US GUIDE YOU

YOU’RE NOT A HOME MOVER IF:

you have never owned a residential property, as you would be classified as a first-time buyer. If you are purchasing a property solely for investment, rental purposes, or as a second home, you are not considered a home mover.

OUR SERVICES: SIMPLIFYING YOUR MORTGAGE JOURNEY

OUR SERVICES: SIMPLIFYING YOUR MORTGAGE JOURNEY

OUR SERVICES: SIMPLIFYING YOUR MORTGAGE JOURNEY

At Barrett Mortgages, we understand that everyone’s financial situation and goals are unique. That’s why we offer bespoke mortgage solutions designed to suit your individual needs.

What am i eligble for

EXPERT MORTGAGE SOLUTIONS FOR YOUR NEXT HOME MOVE

Receive expert mortgage solutions, whether you’re moving home, letting to buy, or purchasing a second home/holiday home.

LET TO BUY: UNDERSTANDING THE PROS AND CONS

Benefit from our expert team’s guidance as we help you navigate the pros and cons of Let to Buy with personalised support every step of the way.

PORTING YOUR CURRENT MORTGAGE: THINGS TO CONSIDER

Discover key considerations and expert guidance to help you decide if porting your current mortgage is the right move for you.

SOLUTIONS FOR SELF-EMPLOYED HOME MOVERS

Including solutions for self-employed home movers with only one year’s income, our expert options simplify the process, even with non-traditional earnings.

As a freelance musician with complex employment contracts, securing a competitive remortgage was tougher than I expected. Barrett Mortgages made it seamless and got me a better rate than I’d hoped for. I highly recommend them!

"I recently had the pleasure of working with Barrett Mortgage Brokers while securing a mortgage for my new home, and I couldn't be more satisfied”

J Burke - London - Freelance Musician

Why choose Barrett Mortgages?

Why choose Barrett Mortgages?

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle. We utilise our years of expertise and work with you to find you the right mortgage.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

Mortgage Solutions Tailored To You

At Barrett Mortgages we specialise in finding a mortgage solution that suits you, your circumstances and your lifestyle.

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Full Support

Our experienced advisors will to support you until the acquisition is complete, ensuring that you are fully informed throughout the process. Never hesitate to give us a call!

Flexible Finance Options

We understand that finances look different for everyone, so we are committed to helping you find a finance option that empowers you.

5* Reviews

5* Reviews

Successful Mortgage Completions

Successful Mortgage Completions

Average response time

Average response time

Chat with a Specialist

Chat with a Specialist

Chat with a Specialist

Chat with a Specialist

Who will guide you through the qualification process. During our initial consultation, we aim to provide an idea of your maximum loan amount, monthly payments, and associated costs where possible, while answering any questions you may have.

Who will guide you through the qualification process. During our initial consultation, we aim to provide an idea of your maximum loan amount, monthly payments, and associated costs where possible, while answering any questions you may have.

Who will guide you through the qualification process. During our initial consultation, we aim to provide an idea of your maximum loan amount, monthly payments, and associated costs where possible, while answering any questions you may have.

Find your solution

Find your solution

Find your solution

Find your solution

Once we have found your solution one of our dedicated advisor's will compare all suitable products and prepare your mortgage application. We’ll then handle the submission and work towards securing your formal mortgage offer.

Once we have found your solution one of our dedicated advisor'will compare all suitable products and prepare your mortgage application. We’ll then handle the submission and work towards securing your formal mortgage offer.

Once we have found your solution one of our dedicated advisor'will compare all suitable products and prepare your mortgage application. We’ll then handle the submission and work towards securing your formal mortgage offer.

Turn Your Dream into Reality

Turn Your Dream into Reality

Turn Your Dream into Reality

Turn Your Dream into Reality

We’ll make the final steps as smooth as possible, coordinating with lenders to ensure a seamless process! —ready for you to get the confirmation to your new venture!

We’ll make the final steps as smooth as possible, coordinating with lenders to ensure a seamless process! —ready for you to get the confirmation to your new venture!

We’ll make the final steps as smooth as possible, coordinating with lenders to ensure a seamless process! —ready for you to get the confirmation to your new venture!

Blogs relevant to this topic

Blogs relevant to this topic

Blogs relevant to this topic

Blog

Let Barrett Mortgages do the searching – and we’ll find the right solution for you.

Let Barrett Mortgages do the searching – and we’ll find the right solution for you.

Click. Chat. Complete!

Click now to connect with our team. After discussing your circumstances, we’ll recommend the best path to completion.

Click now to connect with our team. After discussing your circumstances, we’ll recommend the best path to completion.

Click now to connect with our team. After discussing your circumstances, we’ll recommend the best path to completion.